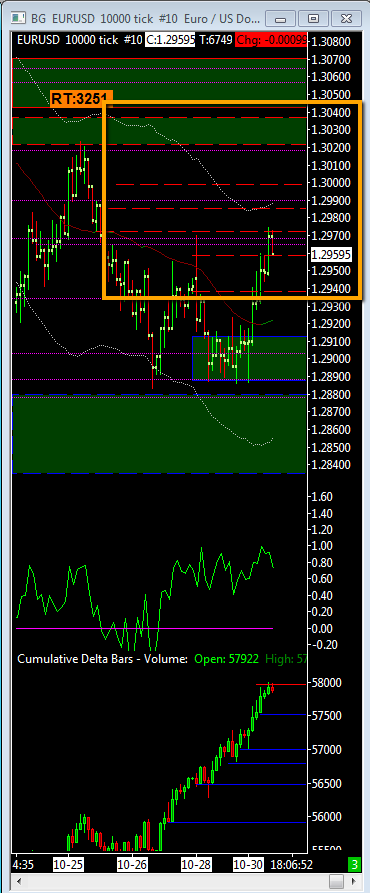

Buyers got interested after a brief rotation around the area marked yesterday and price has gained some momentum. Currently trading at 1.2959 (10:40AM ET).

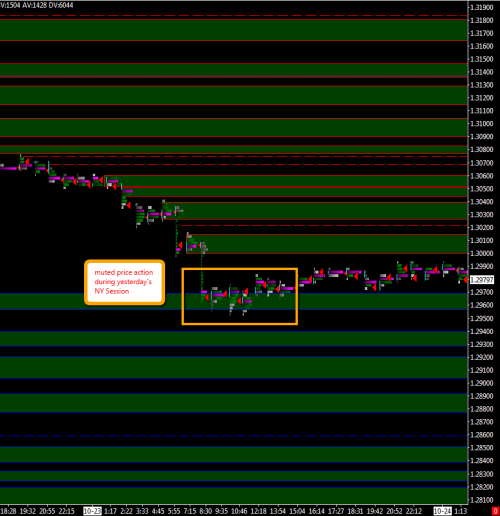

My guess is that once London session liquidity dries up -after noon, ET- we will not see much since the US Markets are still closed today.

However, I want to point out some things.

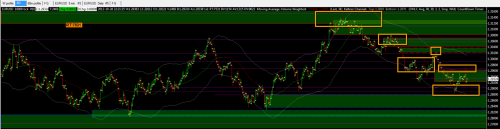

Yesterday, I wrote about 1.2935 about being a key price point. It is still the case. Above that, there’s plenty of space for price to probe into higher areas of value. The red dooted horizontal lines denote that what I have conceptualized as weak areas (see previous posts, but basically the idea beneath them is that price has not sufficiently rotated/probed around, thus making this areas subject to be revisited, at later time)

Also, POCs are worth a mention. Particularly, I’m stressing their importance as key areas to take into account . Specifically:

– 1.2880, 1.2890 & 1.2904. Note on the chart below how price clearly rotated around these numbers, before moving into higher areas of value

– 1.2935.although not as important as the area marked above, theres still some rotation around this number. Price action “took a breath”, before moving into higher areas of value.

– 1.2965 & 1.2968 – price has been rotating around this area, as I’m writing this post.

My point is that these numbers are not random events, but there’s a logic behind them, meaning that they are taken into by market players, collectively speaking.

What to look for? Probably as US markets get back to regular schedule, likely is that we would start seeing some more defined direction.

To the upside, I do not see many interesting areas to sell, until 1.3043-1.3070. Price still might look to fill this area.

To the downside, 1.2879-1.2833 // 1.2827-1.2803 // 1.2810-1.2756 (most important)