This is how the market feels today. It seems everyone was ready for a Thanksgiving rally, which, not only never really materialized, but ended up in the worst form.

I Wanted to post yesterday, but for some reason I had no access to posterous. My open apologies if you were following. I´ll try to post as soon as I can. Drafting my ideas into this blog, is slowly becoming easier.

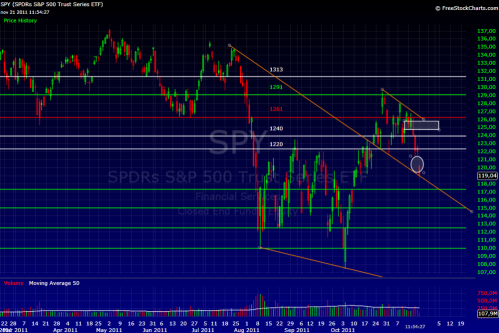

Important levels have been breached. Those posted back in Late July and early August are still in valid.

The levels noted below have provided guidance in my trading and analysis. So far, they are still in force.

As it follows

Some were the levels I´m watching.

1313 – above, SPX could possibly resume the rally

1291 – first mayor test area

1261 – bull market in danger

1240 – a sustained move, could propel into bear market

In fact, there was a small gap dating from early october 117.40-117.73 aprox., which was filled today – Below that, I see 115.20 as a critical level. Above, the SPY would need to fill the gap to regain some traction to the upside.

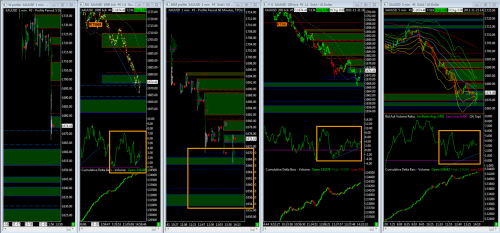

This how the picture is looking now (6:10PM, ET)

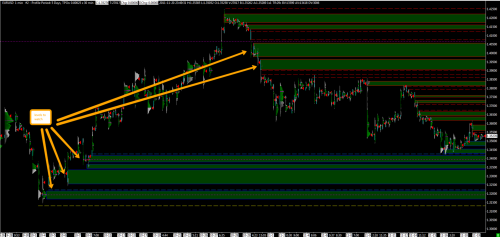

I attribute most of today´s weakness to EUR/USD performance, linked to a poor bond auction in Germany and overnight weakness inginited by HSBC China PMI.

On regards to the levels in play, please see the chart below to have a broad idea of what I´ll be watching during the following days.

To the upside, the first mayor level will be 1180 on the ES. If the market clears that level, we could possibly see more upside, even to 1195, which is almost a confluence zone with the daily chart, posted at the top of the article.

Below, I`ll be watching 1150 and 1140 as important levels. What sorts of concerns me, is the vertical development we had during the last 5 minutes of the cash session, plus the fact that important levels of long inventory that have been breached, which I´ll get into below.

Important to note, the area between 1161 and 1165.50 on the ES is very thin. I do think if the market can regain some upside above 1162, then that could eventually open the door for more upside in the shorter term.

Another matter I want to point out is the 1167.50 level, which referes to a previous POC (point of control). Although some might argue that this leveles has been “breached” several times over the last few sessions, it is important for me to point them out.

I have found out that they have worked for me in the past as important guidelines. See the close up below, and the origins of the POC, back in early October. At last, I have added a longer term view of the whole set of levels in the range.

As for current long/short positions, I pointed out back on Sunday, that they were important levels of long inventory beign held below the current price:

This week I´m even more cautios, mainly due to the reason that we are facing “critical” levels of long commitment in terms of positions held. You´ll see in the chart below, that the Cumulative Delta is showing several levels of commitment in terms of long positions. For example, currently we can see that the down move is testing the commitment of those longs initated at 1165 aprox. on or near late September/early October. If that happens, we could see further upside, geared towards the green line, which are the long positions intiated in early september around the 1150 level. That level is followed closely by those long positons initiated at the 1145 levele, aprox. Thus, if some more sustained downwards/selling pressure comes into the market, the risk of downside is increasing.

Point to be made is that, during the last three days, the commitment of those beign long in the market has been literally erased. They bailed out of their long positions during the selloff, as you may note from the chart below.

The last man standing -initiated @1066, back on October the 4th- is the only one left. Due to the size of the charts, I am posting two images: one from early October -when those longs were initiated- and one of the current situation, so the realtionship between prices/inventory levels can be appreciatted. Now it is up to the last man standing, to keep support. So far (at 7:30PM, ET) it seems to be holding. Therefore, provided it holds during Asia and London sessions, we could see further upside

I´ll try to update the levels in the morning.