It started year into a key swing price price point of 1625, form which propeled until mid-January close to the -also key- $1700.

Price consolidated into the 1698-1685 area for a couple of days, only to get back into lower areas of value, last friday marking the low of the retracement at 1655.

There´s seems to be some sort of balance into the current 1657-1655 area. As previously noted, I tend to respect the type of development Gold experienced back on Friday and look for further continuation of the trend, unless I get some sort of important (and opposite) response, which will signal the importance of the current for buyers who then decide to start acting.

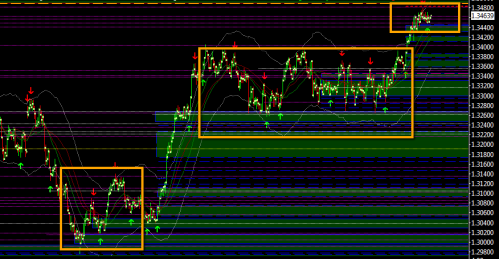

I´ll be watching the following clusters in the days to come

Provided buyers show up -which seems to be the case, at the moment, as I am writing this post at 12:46AM ET- I´ll be looking into 1663-1661.50 as short term resistance folllowed by 1666-1665 & 1670-1668, specifically 1669.

1675 is a key swing area into the current cluster.

Above:

1679-1676

1684-1682

1687-1685

1691-1689, being 1690 a NPOC (important)

Finally, 1698-1696 int the higher cluster.

Alternatively, sellers keeping the pressure will make Gold to visit lower areas of value.

1650 is a key price point where imbalance took place. A break below it, will have me looking at:

1648

1645

Both should provided decent support, unless sellers mantain their advantage, in which the line in the sand will be provided by 1644-1640. followed by 1638-1636.

DP.-